Our approach is simple. We are long-term, founder friendly investors who help forge commercial relationships with our operating companies.

A track record of performance

Meet the team

We are an experienced team focused on the trends, markets and technologies that will change how we live and work tomorrow. We roll up our sleeves and work closely with all of our founders to build successful businesses and enjoy playing a part in their growth.

John Gowen

Managing Partner, Denver

John Gowen leads Liberty Global Ventures. He is a 20+ year veteran of the international telecommunications and media industry. He holds a B.S. in Commerce from The McIntire School at The University of Virginia.

Bruce Dines

Partner, Denver

Bruce Dines is one of the founding partners of Liberty Global Ventures, the Corporate Venture Arm of Fortune 500 Company, Liberty Global, Inc. In that role, he works closely with the members of the Ventures, Technology and Operating teams, and is responsible for co-developing the LGI Technology Investment Portfolio.

Bruce brings over 25 years of technology and telecommunications experience to Liberty Global. Over half of those years have been spent in earlier stage environments, where Bruce has founded companies and led businesses from concept and model development, through the capital formation, revenue generation and team building phases, ultimately realizing successful exits on 3 different companies. The other half of his career has been spent in mid-size and large corporations, where he has either served as President or Division President, including comCables as President, Northstar Exchange as COO (sold to Construction Software Technologies in 2007), EHPT as President (sold to Ericsson in 2002), and Ericsson Mobile Communications as Division President.

Bruce also leads the Spark program within Liberty Global, which drives innovative thinking by applying innovation development principles to Liberty Global’s core operating companies.

Over the past 10 years at Liberty, he has worked closely with the ventures and operating team to co-build and co-manage its growing portfolio of investments.

Don Parsons

Partner, Denver

Don Parsons is an experienced venture capitalist, having spent the last 30 years investing in and helping grow technology companies. He is a seasoned General Partner of 4 Venture Capital Funds totaling over $840 million in capital and has knowledge and/or oversight of over 150 private venture capital investments. He is a current or former Board of Director member of more than 25 companies.

Don is a Partner of the Venture Capital Group of Liberty Global, one of the world’s leading converged video, broadband and communication companies, with operations in six European countries. His current or previous investments include: EdgeConnex (sold to EQT), Revolv (sold to NEST/Google), CloudSense (sold to Vector Capital), Personify (sold to Foxconn), IOTAS, HelloTech, Penthera, Veniam, Thuuz, and SundaySky.

Don previously founded Appian Ventures in 2002 and raised an $80 million venture capital fund that invested in 20 software and technology companies including LeftHand Networks (acquired by HP), Collective Intellect (acquired by Oracle), CareFX (acquired by Harris Corporation), AuctionPay (acquired by Global Payments), and Ping Identity (NYSE: PING)

Don founded Strategos Ventures, LLC in 2000 to make Angel investments in technology companies along with investments in venture capital funds. Angel investments included LeftHand Networks, Stratis Business Centers (acquired by Regus PLC), Lijit Networks/Sovrn (acquired by Federated Media), and Albeo Technologies (acquired by GE). Venture Capital Fund investments include Silicon Valley BancVentures, Purple Arch Ventures, Vanguard Venture Partners, and Sequel Venture Partners.

Don also spent 11 years at Denver based Centennial Ventures, a venture capital firm managing over $760 million focused on media and technology investments. He invested or oversaw investments in Verio ($8 billion acquisition by NTT), HighGround Systems (acquired by Sun Microsystems), Raindance Communications (IPO, acquired by West Media), Cypress Communications (IPO), Pluto Technologies (acquired by AVID), and Tricord Systems (IPO).

Prior to his career in venture capital, Don was a Northwestern University Cooperative Engineer and then a full-time Product Design Engineer with IBM’s Personal Computer Division in Boca Raton, Florida where he received a patent for innovative features of the graphics hardware (MCGA and VGA) for the IBM PS/2 line of computers introduced in 1987.

Don was a founding board member of Colorado’s chapter of the National Association of Corporate Directors. He is a former President and Chairman of the Rocky Mountain Venture Capital Association and a former member of the Board of Trustees of the Graland Country Day School. Don holds a B.S. in Electrical Engineering from the Northwestern University McCormick School of Engineering and an M.B.A. from the University of Michigan Ross School of Business.

Ankur Prakash

Partner, Silicon Valley

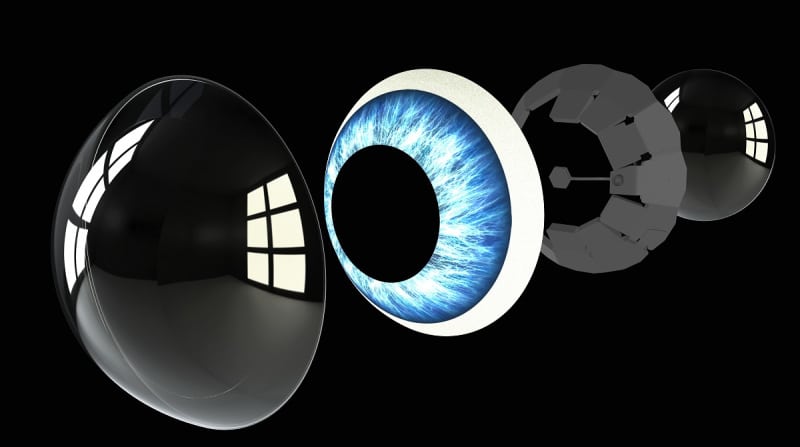

Ankur Prakash has been a Partner at Liberty Global Ventures since 2012. He focuses on investments in the areas of enterprise software, cloud, mobility, core infrastructure and AI. Some of Ankur’s notable investments include Aviatrix, Awake Security (ACQD: Arista Netwotks), Guavus (ACQD: Thales), Lacework, Mindmeld (ACQD: Cisco), Mojo Vision, Plume and Versa Networks.

As a Silicon Valley veteran, Ankur has held leadership roles in engineering, product management and strategy functions at various companies including Cisco, Alcatel-Lucent and Juniper Networks. Prior to Liberty Global, Ankur was responsible for Juniper’s core routing technology platform. As part of Juniper’s venture investment team, he worked on investments in Violin Memory (VMEM), Vidyo and FireEye (FEYE). In 2003, Ankur was a founding engineer at NetDevices, where he led the development of the industry’s first converged gateway product for mid to large enterprises. NetDevices was acquired by Alcatel-Lucent in 2006, and Ankur led the engineering and development of the Access products portfolio.

Ankur holds an MBA from Kellogg School of Management, a MS in Electrical Engineering from Purdue University and a BS in Electrical Engineering from the Indian Institute of Technology, Kanpur, India.

Rebecca Hunt

Partner, London

An experienced investor and operator with a strong background in M&A, venture capital, and scaling high-growth businesses, Rebecca began her career at Deloitte, specializing in M&A and advisory services, where I gained deep expertise in financial strategy, deal structuring, and corporate growth.

Transitioning into venture capital, she played a pivotal role in building the investment team at Octopus Ventures, where she invested across multiple sectors, including consumer, fintech, and deep tech. Rebecca has supported and scaled numerous early-stage companies, guiding them from investment to exit, including Depop and Tails.com, both of which successfully exited.

With a strategic and hands-on approach, she focuses on identifying transformational businesses, supporting founders, and driving growth. She’s passionate about partnering with ambitious teams to turn bold ideas into market-leading companies.

In Numbers

$700m

Capital Invested

$550m

Capital Returned

70

Number of Companies We've Invested In

26

M&A Exits

3

IPOs

16

Unicorns